FUTURES TRADING STRATEGIES

Futures are the most popular trading instruments. Futures trading strategies are, on the one hand, identical to those for trading underlying assets such as stocks, currencies, and indices. On the other hand, derivatives have their own unique characteristics that significantly expand their range of uses. Futures are effective in speculative trading, hedging and arbitrage.

Russian FORTS Futures Market

The Russian FORTS Futures Market trades futures on stocks, stock indices, bonds, currencies, interest rates, and commodity contracts. The most popular are contracts on the US dollar to Russian ruble (Si) exchange rate, the PTC index (RTS), and blue-chip stocks.

Stock futures contracts

The largest number of transactions are contracts with Sberbank, Gazprom, VTB Bank, Ornikel, Magnit, and Aeroflot.

TOP-20 contracts for stocks, FORTS

A futures buyer is in a more advantageous position than a stock buyer, as when entering into a transaction, they only need to pay an initial margin—the collateral—which is significantly less than the value of the underlying securities. When opening a trade, a trader only posts a deposit of 5% to 20% of the total contract value. This collateral is called the initial margin or collateral; it is set by the exchange and specified in the specifications. For example, the settlement price of a Sberbank share futures contract is 29,580 rubles, while the collateral is 5353 rubles, which is 18% of the value of the entire block of shares. An open futures position entails daily adjustments—credits and debits—as the settlement price changes, called the variation margin. This must be taken into account to maintain the required account balance and avoid the unpleasant situation of a margin call. The final result, whether selling a stock or closing a futures position, is equal to the difference between the sale price and the purchase price.

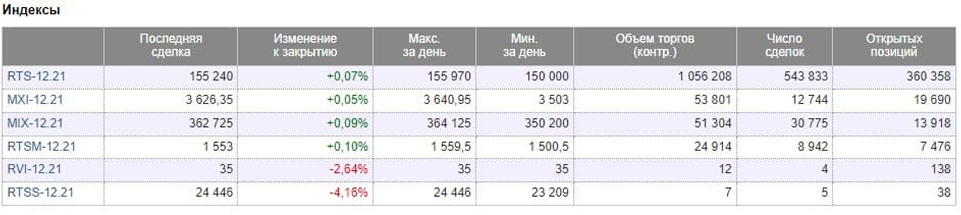

PTC futures

What is a PTC futures contract? The PTC Index (RTSI) contract is one of the most popular speculative instruments on the Russian market. Daily trading volume exceeds 240 billion rubles..

Index futures on the Moscow Exchange

The RTSI is the main indicator of the Russian stock market, reflecting the performance of the shares of 43 largest Russian companies by capitalization (as of December 2021). The number and composition of securities used to calculate the index are periodically reviewed and changed. A stock index futures contract is a purchase and sale of a portfolio of stocks included in the corresponding index. Small retail investors do not have significant resources to purchase a large portfolio, and single-stock futures do not allow them to exploit the full potential of the market. An exchange index contract is an excellent alternative, especially taking into account the built-in leverage in the derivatives market. Futures on PTC have a GO of less than 20% and are used for high-yield speculative operations

Exchange strategies in the futures market

The main exchange strategies in the futures contracts market (futures trading strategies) can be divided into several types: speculative transactions; hedging; arbitrage; spread.

1. Speculative Futures Trading Speculation in the futures market is identical to trading the underlying asset. The logic is simple: buy low, sell high. Futures move almost in sync with the underlying asset, but with a slight difference that diminishes as the expiration date approaches.

Index futures on the Moscow Exchange

Futures strategies offer high-yield, low-cost trading opportunities, and are accessible to traders with small starting capital. This advantage makes derivatives significantly more attractive than trading the underlying assets. For example, if a trader predicts the rise or fall of a certain stock and plans to open a long/short position, they must have sufficient funds on deposit to pay for the stock at the current market price. To buy or sell a futures contract, only the required collateral is required. Futures trading eliminates the need for a broker's leveraged fees, as the derivatives market always offers "free leverage." Speculative trading carries a high level of risk associated with maintaining the required margin for a futures position. It's important to remember about variation margin, especially when the market is moving against you. You can learn how to manage risk wisely, especially when using leverage, on the "Risk Management for Beginners" page.

2. Hedging. Stock investment strategies involve risks associated with price declines due to unpredictable events. One of the original goals of the derivatives market was to protect against risks associated with the uncertainty of future asset price changes. Investors wanted a tool that would allow them to hedge against price risk. Forward contracts allow them to hedge (hedge) transactions. Hedging works by offsetting losses in one market with gains in another. Using forward contracts to mitigate the risk associated with the uncertainty of future prices is called hedging. Hedging is opening a position in the futures market that is opposite to a position in the spot market. For example, with an open long position in a stock and anticipating a market correction, an investor sells a futures contract for the same number of shares. If the stock price declines into the red, the short sale of the futures generates a profit.

3. Arbitrage Arbitrage transactions involve entering into multiple transactions on identical or related assets. Profit is generated from the difference between futures and spot market prices, or between the prices of futures contracts with different expiration dates. You can read about futures expiration in this article. The stages of implementing a direct arbitrage strategy are: 1) purchasing the underlying asset on the spot market; 2) opening a short futures position; 3) delivering the cash asset under futures contracts. Reverse arbitrage is implemented through opposite transactions.

4. Futures Spreads An investor can simultaneously hold long and short positions in futures contracts. This can involve the simultaneous purchase and sale of futures on the same asset but with different expiration dates—a time (intra-market) spread. A bull spread (buying a spread) involves taking a long position on a long contract and a short position on a near contract. A bear spread (selling a spread) involves taking a short position on a long contract and a long position on a near contract. This strategy can be used by entering into transactions with contracts on different underlying assets – an intercommodity (intermarket) spread. For example, contracts for wheat and corn or oil and gasoline and others.

Conclusions

The use of futures significantly expands traders' opportunities to develop high-yield strategies with limited risk and significantly lower costs than in underlying asset markets. The "leverage effect" increases the potential efficiency of trading, opening up new opportunities for traders with relatively small starting capital.