STRATEGIES FOR INTRADAY TRADING

Among the wide variety of trading strategies in financial markets, short-term intraday trading is the most common. Trades that are opened and closed within a single trading session are called intraday, intraday, or day trading. Intraday trading is speculative. The most commonly chosen trading instruments are stocks, index futures, and currency pairs. For more information about different trading styles, see the “exchange trading strategies” page.

Portrait of an intraday trader

Short-term speculation requires traders to have a good reaction, the ability to quickly navigate the situation and also make decisions quickly. Intrade traders must have good concentration, composure, and attentiveness. This style of trading involves a long stay in front of the monitor. It's important to understand that short-term traders make a large number of trades per day, some of which are guaranteed to be closed at a loss, so the ability to tolerate losses is essential for such traders. A different perspective on intraday trading was demonstrated by the outstanding trader Garry Smith, who demonstrated astonishing results over many years. At the same time, he traded relatively infrequently—once or a few times a week. On this subject, he said the following: "Successful intraday trading is not daily trading, and certainly not multiple trades throughout the day."

To be successful, follow the rules.

Intraday trading implies intrastrategy, adherence to certain rules and principles that help achieve maximum efficiency. The first rule concerns the choice of tool. Regardless of the market - stock, forex, futures - the instrument must have high liquidity and volatility. The liquidity of the instrument will allow you to open and close a transaction at the price stated by the trader. Volatility will allow you to earn a good profit in a short period of time. However, instruments that are too volatile carry the highest risks, so they are used mainly by experienced traders who know the nature and features of such instruments well. tools. The second rule is the minimum spread. Compliance with this rule is directly related to the choice of broker. The shorter the timeframe a trader chooses, the greater the influence of this factor. The third rule is accounting for trading costs. Day trading stocks involves paying brokerage commissions. These costs can significantly reduce profits, and if approached incorrectly, they can simply "eat up" all profits. The fourth rule is to trade according to a plan. This is one of the most important principles of successful trading. Before the start of the day, a trader should have a clear plan of action—which stocks to speculate on, which instruments to trade, which signals to open and close trades on, how to set stop-losses, and what risk/reward ratio is considered acceptable. The fifth rule is: don't average down, don't "win back." A trader must adequately assess risks and be able to accept losses. The sixth rule is to be technologically advanced. In short-term trading, the technical side of the issue is of great importance. A good internet connection, a trading platform, the speed of the broker's trade execution, software, and computer performance can significantly impact trading results. Rule seven is discipline. A trader must strictly adhere to all of the listed principles and rules.

Intraday trading strategies in the stock market

Traders who use the Martingale strategy adhere to the following rules: - the initial bet should be minimal; - after the first profitable trade, it is imperative to return to the size of the first bet; - Strictly and strictly adhere to risk and money management rules, as the number of consecutive losing trades can be quite large. The minimum bet should not exceed 1% of the deposit. - The strategy is best applied during a pronounced trend movement; in a flat market, the Martingale strategy is fraught with too large losses.

Use on Forex, formula

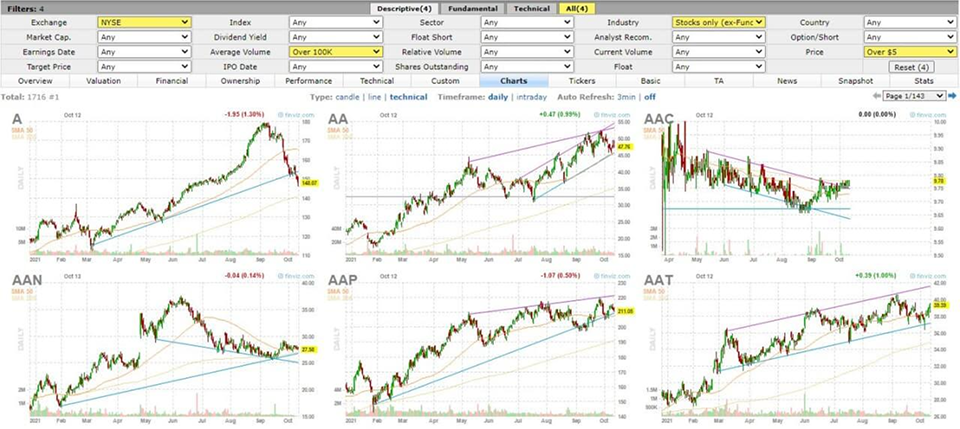

A day trading strategy for stocks has a number of unique features. When choosing securities for short-term trades, in addition to price, liquidity, and volatility, it's important to consider factors such as the average daily range (ATR)—the stock's daily price movement—and the average distance it moves during a trading session. Securities with a low ATR value are not suitable for intraday trading, since the potential profit may be less than trading costs. Beginning traders are recommended to trade the same stocks over and over again in order to understand their nature and dynamics. In this regard, we suggest that beginners study Forex. Day trading in stocks begins before the market opens, with preparation for the trading day. At this stage, securities are selected for trading. Traders select instruments according to their trading system. To facilitate the selection process, specialized programs called screeners are widely used to help filter securities according to specific criteria.

Finviz screener

For intraday trading, we prefer stocks that move within a narrow range; it's best to wait for an exit signal to form. There are also caveats when choosing too-expensive or too-cheap stocks due to potential liquidity issues. Even when trading on 5-minute or 1-minute timeframes, it's important to identify important levels on daily or weekly timeframes. Before important news releases, it's best to stay out of the market. Intraday traders use indicator-based or non-indicator-based strategies. The most common are intraday trading strategies based on breakouts or rebounds from levels.

Level breakdown, Sberbank share (SBER), 30 min, MOEX

Intraday Forex Trading The choice of intraday trading strategy depends on the session in which the trader trades, as trading during the European and American sessions is very different from trading during the Pacific and Asian sessions. Before the release of important news, it is better to close all transactions, because market movements can be unpredictable, and very high volatility and huge spreads can become a disaster for the deposit. Information about the publication time of important statistics is contained in the economic calendar. There are a huge number of trading systems, both automated and manual, for short-term trading. However, most traders use simple but time-tested strategies, based on the principle: all ingenious is simple! Short-term EMA + RSI strategy. A simple intraday Forex trading strategy is based on the Moving Average and RSI indicators. Moving averages are established with periods of 5 and 12, Exponential. The RSI is established with a period of 14, with levels 30, 50, 70. The time frame is 5 minutes, more suitable for GBPUSD, EURUSD pairs. A buy signal occurs when MA 5 crosses MA 12 from bottom to top, and the RSI indicator crosses level 50 from bottom to top. The price chart crosses the moving averages from bottom to top. Entry is on the next bar. Stop-loss is set behind the nearest local low. Take-profit is 10-15 points.

The sell signal is the opposite.

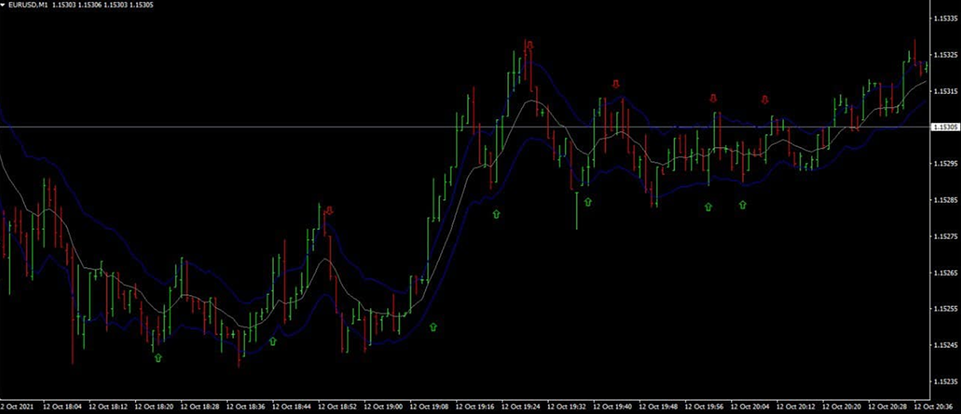

GBPUSD, M5

Scalping strategy on a minute time frame Scalping is well suited for night trading. During the Pacific session, when the market is quite calm and predictable, risks are minimized. An important factor for this technique is the size of the spread. Major pairs are more often chosen for trading, because Their spread size is minimal. This strategy uses the Keltner Channel indicator. Trading is identical to any channel strategy. The channel boundaries can diverge, indicating a strengthening trend, or they can converge, indicating a flat market. During a trend, traders use a breakout technique. A candle closing outside the outer boundaries is a signal to open a trade. A stop-loss is placed beyond the opposite channel boundary. As the price moves, the stop can be moved along the boundary. During overnight sessions, the market is often in a sideways channel—flat. A "rebound" technique is more suitable for this situation. Trades are entered when the candlestick breaks the channel boundary in the opposite direction. For example, if the upper channel boundary is broken, a sell trade is opened, and vice versa. The logic is that the price won't be able to move far from the channel boundary due to a lack of market activity. Stop orders are set based on each specific situation. But this should be a minimum level that indicates the market has moved against the trade. Then it's best to close the position with minimal losses. Whether to scalp or day trade is up to you.

Keltner Channel, EURUSD, M1

Intraday trading strategies have both advantages and disadvantages. The advantages include: a large number of trading signals; no need to "wait out" pullbacks or long periods of consolidation. The trader immediately takes profits from the market; and the ability to make decisions based on technical analysis without complex fundamental research. The disadvantages include: A large number of false signals on small time frames. The tangible impact of trading costs on the result. Psychological factor due to long-term observation of the price chart.