SIMPLE OPTIONAL STRATEGIES

Options are a complex, yet fascinating, flexible, and extremely versatile instrument. Most traders underestimate the opportunities offered by options strategies and options trading methods for limiting risk and maximizing profits. In this article, we'll explore what options trades are, the different types available, and the best options strategies. There are a huge variety of combinations for building an effective system in a constantly changing environment. The secret to success lies in assessing the market situation and using the model or design that will allow for its most effective use. And there are a great many options for this. But the most important rule is that the market dictates the choice of model, but not the other way around!

Types of option strategies

Options offer a wide range of options options. Therefore, there are various options strategies—types that can be grouped. Strategies using this instrument can be divided into specific groups: speculative models—the simplest operations based on the rise or fall in the price of the underlying asset; buying or selling volatility are transactions that allow you to make money in any market direction or within a certain range. spreads - simultaneous purchase or sale of contracts of the same type, but with different strikes or expiration dates; hedging is the insurance of open positions in the underlying asset in order to insure against unfavorable price movements.

Mathematical trading strategies

Options offer a wide range of options options. Therefore, there are various options strategies—types that can be grouped. Strategies using this instrument can be divided into specific groups: speculative models—the simplest operations based on the rise or fall in the price of the underlying asset; buying or selling volatility are transactions that allow you to make money in any market direction or within a certain range. spreads - simultaneous purchase or sale of contracts of the same type, but with different strikes or expiration dates; hedging is the insurance of open positions in the underlying asset in order to insure against unfavorable price movements.

Speculative trading (buying direction)

The simplest operations are buying put options if a market decline is expected, or call options if a rise is expected. Losses are limited to the cost of acquiring the contract, while potential profits are unlimited. Simple options strategies allow you to make speculative trades, profiting from rising or falling markets while limiting your risks to the amount of premium paid.

Example 1. When expecting an increase in Sberbank shares, you can consider purchasing a call.

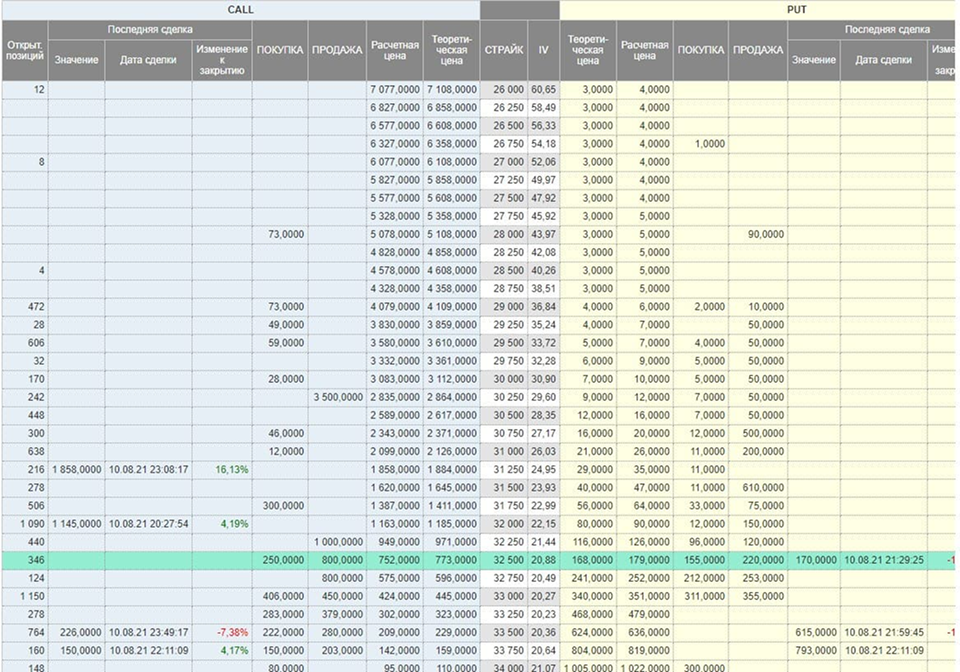

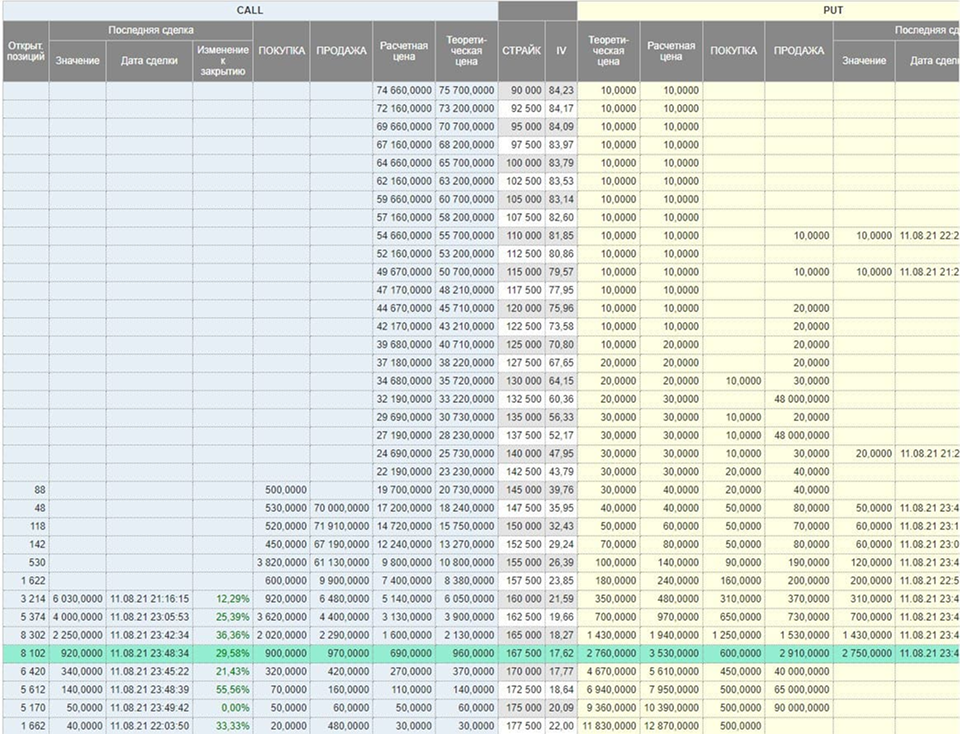

Options on SBRF 9.21 futures

By purchasing a 32500 ruble strike for 250 rubles, if the scenario is realized and the instrument grows to 33500 rubles, you can count on a profit of: (33500 - 32500) - 250 = 750 rubles. The maximum risk in this case is 250 rubles, whereas when buying 100 shares in a negative scenario, its size could be much greater.

Example 2: If an investor expects the market to decline, he will consider buying a Put.

Options on PTC index futures contract

Purchasing a put on a PTC futures contract with a strike price of 167,500 rubles for 600 rubles can generate a profit if the price falls to 162,500 rubles in the amount of (167,500 - 162,500) - 600 = 4,400 rubles. The risk in this case would be limited to 600 rubles. Mirror-opposite transactions are sales of contracts.

Spread strategies

During a moderately rising or falling trend, options trading strategies such as bullish and bearish spreads (vertical spreads) are used. The presence of a pronounced directional movement is suitable for constructing a vertical spread.

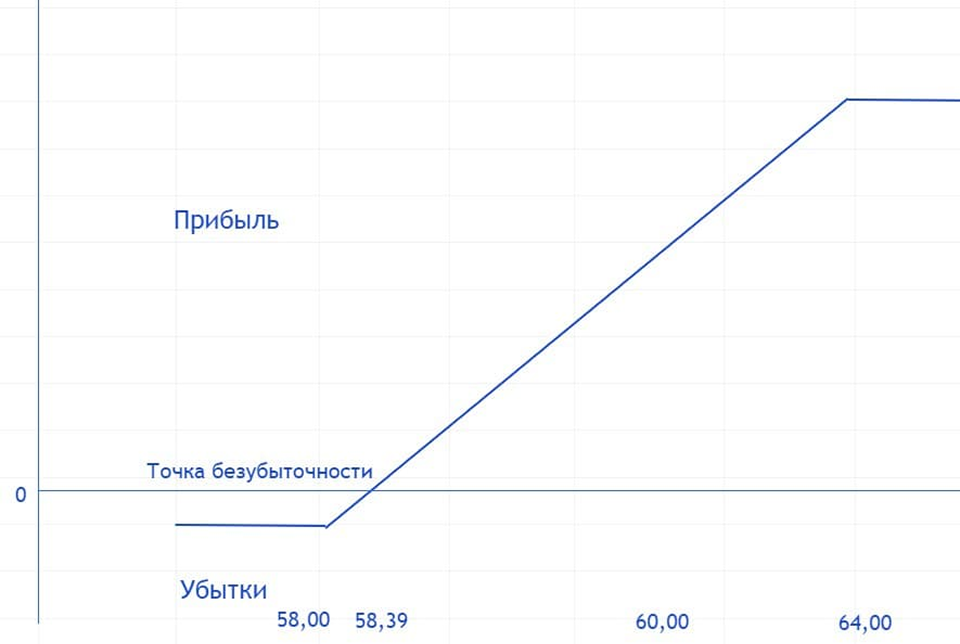

Bullish Call Spread

A bull spread- is an options strategy that exploits an uptrend and involves simultaneously opening long and short call positions with different strikes. The long call is sold out-of-the-money, with the expectation that the price will not reach it before expiration. In a rising market, the purchased call "profits." Profit is generated in the range between strikes. On the expiration date, income is increased by the premium from selling the long-range option. For example, an investor purchases a call on XOM shares with a strike price of $58 for $0.39 when the shares are trading at $58.14. They simultaneously sell a call with a strike price of $64 for a premium of $0.01. The net cost of the trade is $39 - 1 = $38. If the stock rises to $60 on the exercise date, the profit is (60 - $58) x 100 - $38 = $162. If the stock falls below $58, both options are worthless, and the loss is $38.

Bullish call spread model

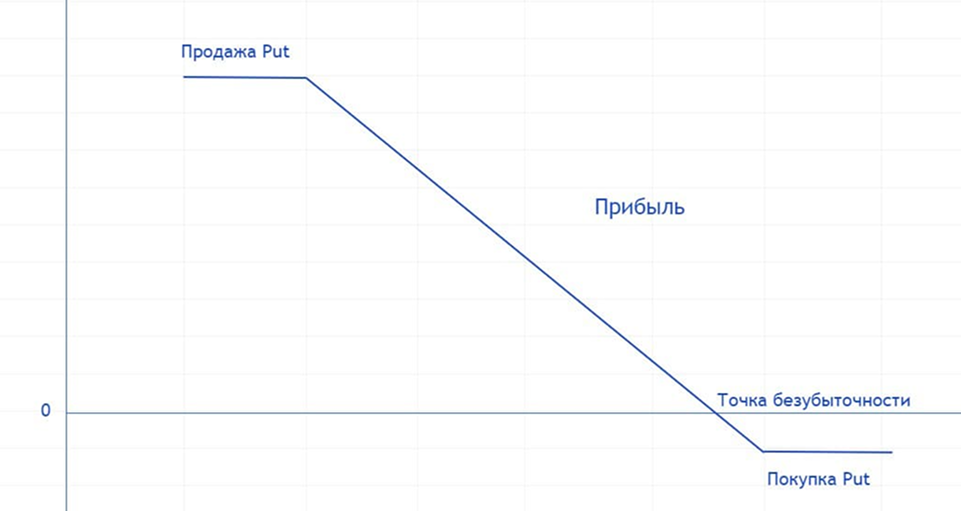

Bearish Put Spread In a bearish market, when an investor believes that the underlying asset will fall to a certain level within a certain period of time, a bearish put spread is the ideal solution.

The construction is a Long Put and a Sort Put with different strikes.

Bearish Put

Profit is generated in the range between strikes. When the contract is exercised, profit is increased by the premium from the sold contract. If the situation develops contrary to the investor's forecast and the market reverses, the value of the sold put offsets the loss. When the price falls beyond the downside strike, the loss on the sold contract offsets the gain on the purchased put, as it is now in-the-money. The primary advantage of a bearish put spread is the ability to minimize the net risk of the transaction. The costs of such transactions are lower than those of simply buying puts or shorting stocks and futures. Spread strategies for options allow you to profit during a trend, reducing costs through counter trades and limiting the size of losses. Spreads can also be horizontal, differing in terms of expiration.

Volatility Buy/Sell Options Strategies”

The situation when, after a long sideways trend, the emergence of a new trend is expected is very typical. To determine the moment at which a new trend begins and its direction, methods of technical analysis and graphical models are widely used. More information about them on the “patterns in trading” page. In such situations, option strategies such as straddle and strangle are used. These strategies are most appropriate after a long lull before the release of important news that could disrupt the balance and set the market in motion. You can read about the specifics of trading on news on the "Stock Trading Strategies" page.

Straddle

Buying a long straddle can be profitable when an investor is unsure of their direction. This construction involves simultaneously buying both a call and a put option with the same strike and expiration date. In a rising market, the value of the call increases, while in a falling market, the value of the put increases. The transaction begins to make a profit when the price goes beyond the range formed by the strikes + paid premiums. At the same time, it does not matter which direction the market will go. The maximum risk of a straddle is limited by the amount of premiums paid.

Strangle

Buying a strangle is a combination of long calls and puts at out-of-the-money strikes. In other words, the investor defines a range beyond which the price will not go until the expiration date. The logic behind this construction is very simple. The trade will generate a profit if one of the options goes in-the-money by the total value of the purchased contracts. Traders use this model in speculative trading, profiting from strong, momentum movements. The advantage of a strangle over a straddle is lower overall risk, as the cost of out-of-the-money contracts is significantly lower than the cost of at-the-money options. The disadvantage is the wider price range beyond which the structure begins to make money. For example, buying a 10,000 put at 1000 and an 11,000 call at 1200, with the current futures price at 10,500, will start to make a profit when the asset price rises from the 11,000 strike by the total cost of buying the contracts (1000 + 1200 = 2200) and continues to rise. Or, if the market declines, the price will fall below the 10,000-2200 strike and continue to decline. The maximum risk on the trade is 2200. A strangle can generate greater profits than a straddle, but it requires stronger momentum. During flat trading, constructions called volatility selling are used, and their logic is based on the assumption that the price will not leave a certain range. The most well-known constructions of this type are the "Butterfly" and "Condor." A variety of options strategies allow you to profit in various markets by exploiting the characteristics of the current moment. The price dynamics of the underlying asset dictates the choice of the optimal option.