MARKET STRATEGIES FOR FOUNDATION MARKET

Any successful trader carries out his activities according to certain rules and a developed action plan, which together represent his strategy. Developing a trading strategy is the most important aspect of successful activity in the stock market, it eliminates randomness, leads to consistency, and ensures efficiency. Strategies may differ according to certain criteria: according to the timing of transactions - short-term, medium-term and long-term, and from here - speculative trading (in particular, speculative strategies) and investing; according to the direction of the trade - bullish - in a rising market or bearish - in a falling market; By the degree of acceptable risk—conservative (low risk), moderate (medium risk), and aggressive (high and very high risk). Other classification criteria can also be used, or the proposed points can be further detailed. For example, the short-term strategies section could include scalping, arbitrage, or others. A long-term stock trading strategy can be focused on dividend income or investing in undervalued stocks. IPO trading is also a separate area.

Top Investors in the Stock Market

The trading strategy on the stock exchange (as trading strategies on the stock exchange are called) divides all traders into two large groups - long-term investors and speculators. Long-term investors trade in bull markets, buying securities for the long term—more than a year—and making a profit from the difference between the purchase and sale prices, plus dividend or interest income if the securities are classified as such. Investors use fundamental analysis data, study the market situation as a whole and in individual sectors and industries of the economy, analyze the issuer's financial statements using balance sheet data, profit and loss statements, cash flow statements, study the dynamics, forecasts of rating agencies and other information that is related to the selected asset. An investor views the company they're considering buying as a business, assessing its performance, sustainability, and growth potential. Trading shares on the stock exchange is an art form for them.

Speculators or short-term traders typically trade intraday, profiting from the slightest price fluctuations. They use technical analysis data, with the exception of news trading strategies, where forecasts for key economic and financial indicators are essential. For them, the primary sources of information are price charts, trading ranges, the direction of the current trend, and strong key levels.

Long-term and medium-term trading strategies

Stock market trading for long-term or medium-term investors is based on fundamental analysis. Therefore, there are long-term and medium-term trading strategies.

Investing in exchange-traded funds (ETFs) is essentially a portfolio strategy, the difference being that you don't have to build the portfolio yourself.

A dividend strategy involves purchasing securities with high, stable dividends. Investors focus less on the stock's price growth and more on the issuer's dividend policy.*

Investing in an IPO is the purchase of securities during an initial public offering on the stock exchange.

Choosing a stock to trade

As an example of choosing an investment object, we can consider the analysis of shares of the Chinese automaker NIO Inc.

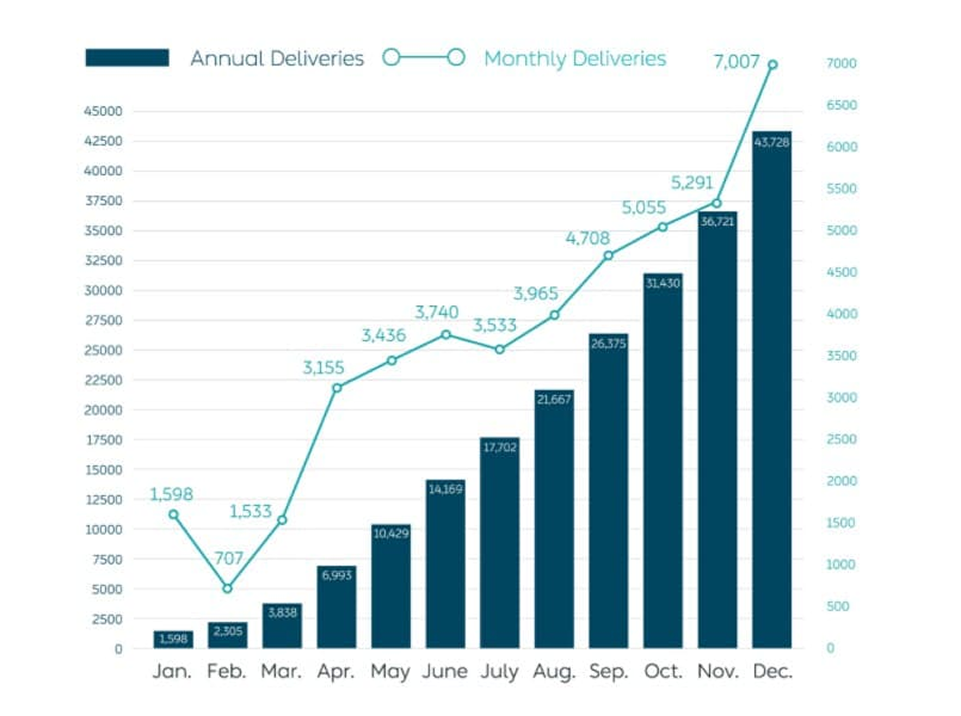

Schedule of car deliveries in annual and monthly terms in 2020

In 2020, Nio more than doubled its electric vehicle sales to 43,728 vehicles, and analysts expect sales to reach 100,000 in 2021 as the company expands production capacity in China and plans to enter the European market.

NIO, TSLA, LI, and XPEV Stocks in 2021

NIO's price is below the 50-mark MA near $39.5 as of April 1st. The 200-mark MA serves as support.

NIO, D

However, despite NIO's shares suffering from the sell-off, they could be added to an investor's watch list. The company operates in a country where the government is making significant efforts to accelerate the transition to green cars by providing business support. NIO's price, according to analysts, significantly outperformed fundamentals at the beginning of the year, but a recent decline has seen the company's shares reach a level that could be attractive to long-term investors. Given market volatility, a continued correction in the sector is expected, which could further reduce NIO's value. Analysts assess risks by looking at a security through a gradual accumulation of positions. When researching, investors can apply comparative analysis based on multiples such as P/E, P/B, P/S, and others, or use the free cash flow discounting method. In any case, the approach to analysis is consistent with the specific intraday strategy of each trader and bears the imprint of his individuality.

Short-term strategies

Intraday traders make trades during one trading session. Therefore, they are of little interest in the distant prospects of a business or industry. For them, the situation here and now is important. Short-term traders use technical analysis data. The main tools are the chart, the market depth and the quotes feed. Among the most popular intraday strategies are: trading from levels – breakouts, rebounds from support/resistance lines, trading false breakouts; channel trading; strategies using technical indicators; non-indicator strategies – price action, chart patterns, VSA; arbitrage trades. Trading on the stock market is associated with high risks. Therefore, the number one task for every trader is capital preservation. A working strategy is the first step towards solving this problem; represents a set of goals, methods for achieving them and the tools used. Any strategy is based on analytical market research, rules for opening and closing a transaction, conditions for holding a position, principles of risk and capital management. The knowledge, experience and personality of the trader have a great influence.