BACKTECTING TRADE STRATEGIES

Having a working and effective trading strategy is a mandatory and necessary condition, the key to successful trading. Before applying a strategy to a real account, it makes sense to diagnose it, check its functionality and effectiveness, and evaluate all its strengths and weaknesses. This process is called testing trading strategies. Since when trading on a real account, any shortcomings will cost the trader their own money. Backtesting is a necessary component of a trader's work—the process of evaluating the effectiveness of a trading system based on historical data. Backtesting makes it possible to understand how effective a strategy is over time, in which markets it shows the best results, and where it simply loses money. Trading tools are huge, and sometimes a small adjustment can have a significant impact on the final result. Backtesting shows which parameters will work better than others and when. More information about the variety of instruments is available on the "Stock Trading Strategies" page. How do you backtest trading systems? Backtesting, as a process, can be manual or automated. The first option involves analyzing completed trades and summing up the results, examining them against various criteria. The second option requires automated software that finds trades consistent with the selected strategy and then determines their effectiveness based on a set of parameters. To automate this process, MetaTrader offers a special program called the Strategy Tester. The program processes large volumes of data and provides detailed statistics that allow you to evaluate all the strengths and weaknesses of trading.

Testing trading strategies

In order to make a conclusion about the profitability and efficiency of trading, you can use various approaches: conduct a manual analysis based on historical data; use a special program built into the trading terminal or use testing programs from the Internet.

How to test a Forex strategy on historical data

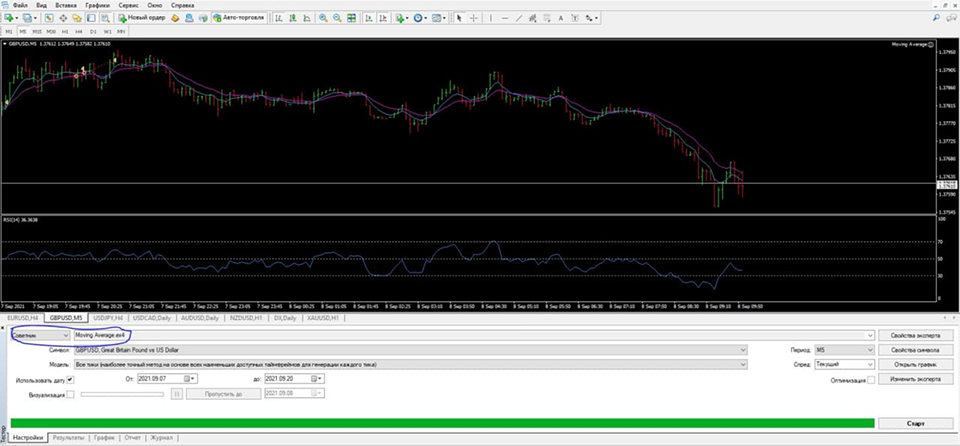

The effectiveness of a trading system can be analyzed by studying charts over a specific period of time, using a selected timeframe. The instrument's history is, so to speak, "rewinded," returned, and analyzed post-mortem. To do this, a visual analysis is carried out and signals for opening and closing trades are identified, and potential profits and losses are compared.

GBPUSD, 1H, testing the forex strategy of buying when breaking through resistance levels, signals for opening

The testing strategy includes: Determination of the main parameters - position volume, trade opening signals, risk/reward ratio, acceptable risk per trade. Selecting an instrument and timeframe, testing period. Analysis of graphs to search for input and output signals. Recording all trades and calculating potential profits and losses. Calculating the impact of all possible commissions and other associated costs. Defining trading profitability as the ratio of profit to invested capital.

Many successful traders have spent countless hours studying charts, exploring all the possibilities and options. This is a labor-intensive process, and it's easier to entrust everything to automated systems. However, it also provides invaluable experience in viewing the market, recognizing patterns, and understanding the characteristics of various instruments. The main drawback of this method is that the market looks different after the fact than it does at the moment when decisions need to be made. Nevertheless, studying history is certainly useful, and it doesn't cost money. The easiest way to evaluate your trading approach is with a demo account. This allows you to trade real instruments in real time, in a situation that is no different from real trading. Here, every detail comes into play—the trader's reaction, the speed of order execution, and many other factors. This type of work is necessary to identify shortcomings and gain an understanding of the effectiveness of the chosen strategy in real time. Advantages and disadvantages: results are virtually indistinguishable from trading on a real account; negative results do not affect clients' funds; losses remain virtual. The disadvantage is that when trading in real time, a trader receives signals as they appear in the current market, and this requires more time than backtesting.

Automatic strategy tester

Backtesting can be carried out using a special program built into the MT4 or MT5 terminals - a strategy tester. The program allows access to historical data for all chart timeframes, markets, and assets, as well as a wide range of technical indicators for testing virtually any strategy, and to check the effectiveness of both manual and automated trading systems—robots or advisors.

Use on Forex, formula

A day trading strategy for stocks has a number of unique features. When choosing securities for short-term trades, in addition to price, liquidity, and volatility, it's important to consider factors such as the average daily range (ATR)—the stock's daily price movement—and the average distance it moves during a trading session. Securities with a low ATR value are not suitable for intraday trading, since the potential profit may be less than trading costs. Beginning traders are recommended to trade the same stocks over and over again in order to understand their nature and dynamics. In this regard, we suggest that beginners study Forex. Day trading in stocks begins before the market opens, with preparation for the trading day. At this stage, securities are selected for trading. Traders select instruments according to their trading system. To facilitate the selection process, specialized programs called screeners are widely used to help filter securities according to specific criteria.

The trading strategy tester allows you to set and change the settings of the indicators used, the distance of protective stop-orders, and limit the maximum number simultaneously open orders, set the time when trading will be prohibited. In the advanced settings, you can set your own parameters - trading limits, margin levels and commissions. Detailed information about the results is presented in the "Testing Report" section. Here you will find complete detailed statistics on all transactions. Testing a strategy with work The program for testing trading strategies is very useful when installing automated trading systems. Robots and advisors, after they are installed in the terminal, are displayed in the corresponding window.

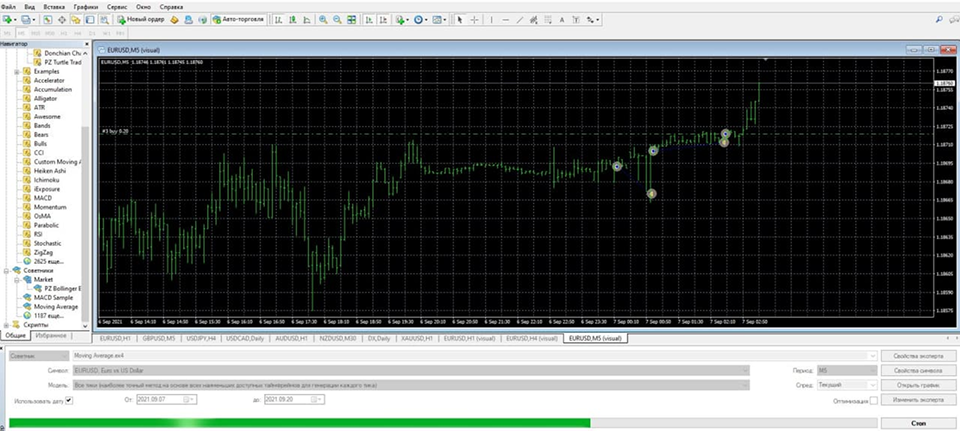

Before testing a strategy with robots, select the trading instrument and the analyzed period. The settings include a visualization function that reproduces the price movement on the selected timeframe for the period being tested. The trader sees the advisor in action.

Visualization of the Moving Average Advisor After completing the check, full statistics of completed transactions are available.

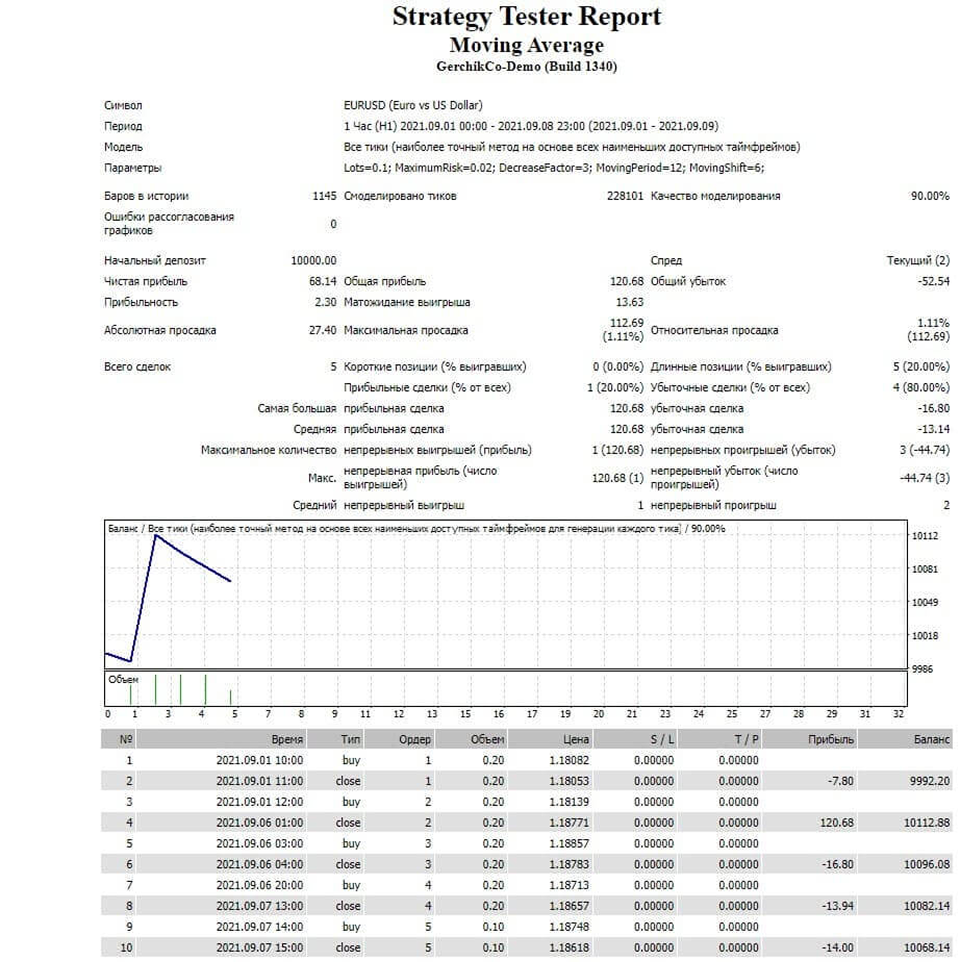

A report on the use of the advisor on the EURUSD pair, on an hourly timeframe for a period of 7 days

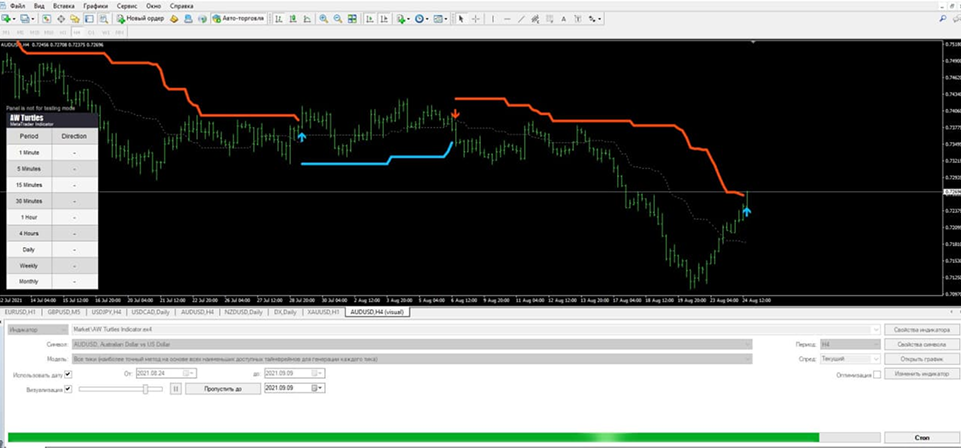

The program for testing advisors allows you to test and optimize any strategy. To do this, tests are “run” with a different set of parameters, choosing the best option. Using a tester for indicators When using technical indicators, you can also check their performance against history. Visualization allows you to get a clear idea of how the indicator works before making a decision about the feasibility of its use. To do this, in the settings, instead of the advisor, select the “indicator” tab.

This is what the visualization of the Turtle Strategy indicator looks like

Using a tester allows you to quickly process vast amounts of information that would be simply beyond the capabilities of a human. This data helps you identify the strengths and weaknesses of your chosen strategy. The audit results are used to calculate trading performance indicators such as: return on equity - the ratio of profit to invested capital, expressed as a percentage; profit to loss ratio; annual income; It's important to remember that backtesting shows how a strategy performed in the past, and this cannot guarantee its effectiveness in the future, as markets are volatile by nature. Therefore, while understanding the undeniable benefits of backtesting, one cannot rely solely on its results. Over-optimizing your trading can be counterproductive. Some traders are constantly refining their strategies, pushing them to the maximum possible relevance to current market conditions, which reduces their longevity. Because with the slightest changes in the market situation, the system will no longer adapt to them. Backtesting trading systems is an important part of being a successful trader. Manual or automatic methods of conducting backtests have their own characteristics and advantages, but, in any case, they make it possible to objectively evaluate your success in trading, Perhaps, reconsider your approaches in the future.